Presented by Australian Property Lovers

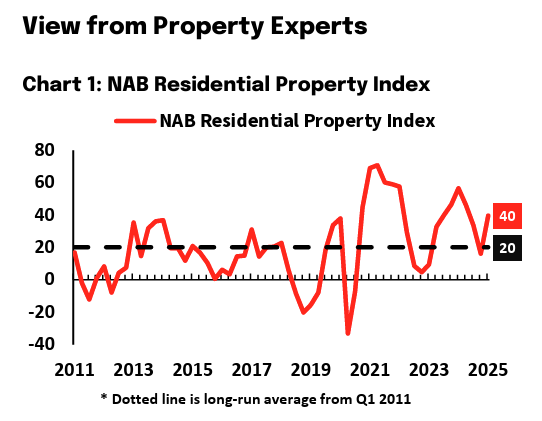

The Australian property market is back in motion—and savvy investors are positioning for the upswing. According to the latest NAB Residential Property Survey (Q1 2025), buyer sentiment has bounced strongly, and Victoria is officially on the path to recovery.

At Australian Property Lovers (APL), we offer over 2,700 investment properties nationwide, and while we see opportunities across Queensland, NSW, WA, SA, ACT and beyond, the numbers are clear: Victoria is becoming one of the most strategic plays for growth-focused investors.

🧠 What the Data Tells Us: VIC Market Is Reawakening

- Victoria’s market sentiment jumped from -22 to +16 in Q1 2025, showing renewed optimism among property professionals.

- 44% of experts now say VIC is either rising or at the start of recovery, with house prices forecast to grow 0.8% in 12 months and 3.2% over 2 years.

- Rental yields in VIC remain healthy, with growth forecast at 2.2% next year and 3.2% over two years.

- Key constraints like planning permit delays (73% in VIC) and construction costs are capping new supply—creating tight conditions ideal for capital growth.

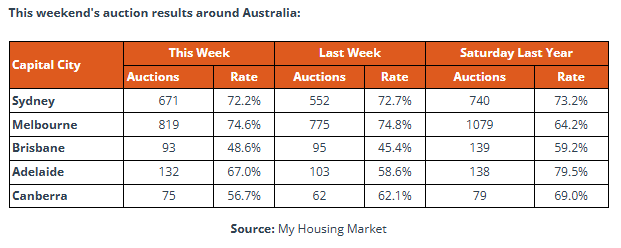

🔨 Melbourne Auction Market Leading the Nation

On Saturday, May 10th, 2025, Melbourne once again outperformed all other capital cities in both auction volume and clearance rates, according to Property Update. This consistent dominance signals that real buyers are back in the market and that Melbourne’s rebound is no longer a theory—it’s happening.

This uptick is not a flash in the pan—it’s validation of NAB’s data and a signal for investors to act early before the crowd follows.

💸 Falling Interest Rates Add Fuel to the Fire

NAB forecasts that the cash rate will drop to 2.6% by early 2026, following February’s cut and further easing expected throughout 2025. This translates to cheaper borrowing, improved affordability, and increased competition for quality property.

With repayments on a $600,000 loan potentially dropping by more than $500 per month, it’s the kind of lending environment investors dream of.

🔑 How APL Helps You Win in Today’s Market

At Australian Property Lovers, we do more than sell properties—we design investment blueprints tailored to your goals, financial structure, and timeline. Our clients get access to:

| APL Property Types | Why It’s Valuable Right Now |

|---|---|

| House & Land Packages | High-yield, low-entry properties in VIC growth corridors and across regional QLD, SA, WA. |

| Dual Occupancy/Dual Living | Maximise returns with 2 rental incomes on 1 title—especially popular with SMSF and multigen investors. |

| Rooming Houses & Co-Living | Achieve 8–10% yields in undersupplied Melbourne and Brisbane suburbs. |

| FIRB-Approved Apartments | Ideal for foreign investors looking to lock in VIC & NSW before availability tightens further. |

| SMSF-Compliant Investments | Long-term compliant products with depreciation and capital growth benefits across all major states. |

With over 2,700 investment properties on our platform, you can leverage the power of choice, data, and national reach—while targeting VIC for optimal timing.

🌏 National Reach, VIC Opportunity

While we proudly offer opportunities in every corner of Australia, our data-driven systems highlight Victoria as the state poised for outsized returns due to:

- Strong demand and tight rental stock

- Market sentiment returning fast

- Infrastructure investments across Melbourne, Geelong, Ballarat and Bendigo

- Buyer activity rising despite limited supply

🎯 Want First-Mover Advantage? Let’s Talk

If you’re waiting for perfect market timing—this is it.

Whether you’re looking for capital growth, positive cash flow, or SMSF strategy, our expert team at APL is ready to help you build a plan that wins now and into 2026.

📚 Further Reading & Resources

| Title | Description | Link |

|---|---|---|

| NAB Residential Property Survey Q1 2025 | NAB’s survey shows strong sentiment rebound, with VIC now back in recovery mode. | Read Report |

| Melbourne Auction Report – May 10th 2025 | Melbourne leads in auction volume and clearance rates, confirming market resurgence. | Auction Insights |

| NAB Forecasts Interest Rate Cuts to 2.6% | NAB’s economic team expects multiple rate cuts through 2025 into early 2026. | Market Outlook |

| FIRB Policy Updates (2025) | FIRB policy changes limiting foreign buyer access to established dwellings. | FIRB Australia |

🎯 Want First-Mover Advantage? Let’s Talk

✅ Book your free strategy session below

✅ Access exclusive investment properties across Australia

By Australian Property Lovers

Author: Anish Lakhani

✉️ info@australianpropertylovers.com.au

🌐 www.australianpropertylovers.com.au